Podcast Welcome to Enabling Green Mobility Podcast!

In this podcast, we delve into the topics that shape our company and the broader industry.

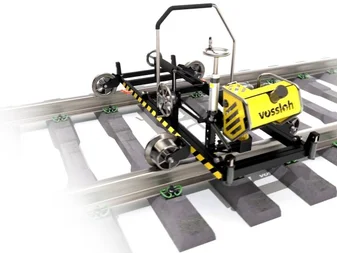

Join us as we sit down with colleagues from various departments at Vossloh to discuss their work, experiences, and the unique challenges they face. Through candid conversations and expert interviews, we explore the cutting-edge developments and industry trends that are redefining rail infrastructure.